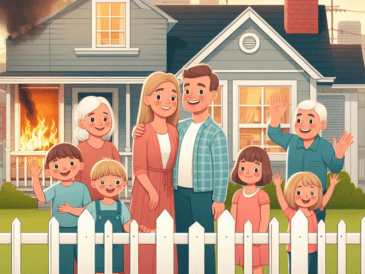

Your home is more than just a place to live—it’s your sanctuary, your refuge from the outside world. But what happens when the unexpected strikes? From natural disasters to accidents and theft, unforeseen events can threaten the safety and security of your home and loved ones. That’s where home insurance comes in—a powerful shield that protects your sanctuary and provides peace of mind in times of crisis. In this comprehensive guide, we’ll delve into the essential aspects of home insurance, empowering you to safeguard your most precious asset.

The Foundation of Protection: What Home Insurance Covers

Home insurance is a comprehensive financial safety net designed to protect your home, personal belongings, and liability exposure in the face of various risks and perils. Here’s a breakdown of the primary components of home insurance coverage:

- Dwelling Coverage: This foundational component of home insurance safeguards the physical structure of your home—its walls, roof, foundation, and attached structures—against perils like fire, windstorm, hail, lightning, vandalism, and more. In the event of covered damage or destruction, dwelling coverage provides funds to repair or rebuild your home to its pre-loss condition.

- Personal Property Coverage: Your personal belongings—furniture, clothing, electronics, appliances, and other possessions—are valuable assets deserving of protection. Personal property coverage reimburses you for the cost of repairing or replacing these items if they are damaged, destroyed, or stolen due to covered perils, whether at home or elsewhere.

- Liability Protection: Accidents happen, and liability coverage shields you from the financial consequences of bodily injury or property damage for which you or a family member are legally responsible. Whether it’s a slip-and-fall accident on your property or accidental damage caused by a family pet, liability coverage helps cover legal fees, medical expenses, and settlement costs.

- Additional Living Expenses (ALE): When disaster strikes and renders your home uninhabitable, ALE coverage steps in to cover the additional costs of temporary living arrangements, such as hotel stays, rental accommodations, restaurant meals, and other necessary expenses, until your home is repaired or rebuilt.

- Medical Payments Coverage: If a guest sustains injuries on your property, regardless of fault, medical payments coverage can help cover their medical expenses, ambulance fees, and other necessary healthcare costs. This coverage extends a helping hand in times of need and fosters goodwill with visitors.

Tailoring Coverage to Your Needs: Customizing Your Policy

No two homes—or homeowners—are alike, and that’s why home insurance offers flexibility and customization options to suit your unique needs and circumstances. Here are some considerations for tailoring your coverage:

- Coverage Limits: Assess the value of your home and personal belongings to determine appropriate coverage limits that adequately protect your assets. Work with your insurance agent to ensure your coverage aligns with the replacement cost of your home and possessions.

- Deductible: Choose a deductible that strikes the right balance between affordability and out-of-pocket expenses in the event of a claim. Opting for a higher deductible can lower your premiums, but be sure you can comfortably cover the deductible amount if needed.

- Endorsements and Riders: Depending on your lifestyle and property characteristics, you may benefit from additional endorsements or riders to enhance your coverage. Consider options like flood insurance, earthquake insurance, scheduled personal property coverage for high-value items, or identity theft protection.

- Discount Opportunities: Insurance companies offer various discounts to policyholders that can help reduce premiums without sacrificing coverage. Ask your insurer about discounts for bundling home and auto insurance, installing safety and security devices, maintaining a claims-free history, or having a new home or renovations.

Navigating the Claims Process: What to Expect

In the event of a covered loss or damage, filing a home insurance claim can provide the financial support needed to recover and rebuild. Here’s what to expect during the claims process:

- Prompt Notification: Notify your insurance company of the incident as soon as possible to initiate the claims process. Be prepared to provide relevant details, including the date, time, location, and nature of the loss or damage.

- Documentation and Evidence: Document the extent of the damage or loss by taking photographs or videos and compiling an inventory of affected items. Keep any relevant receipts, invoices, or repair estimates to support your claim.

- Claims Adjuster Assessment: A claims adjuster will assess the damage, review your policy coverage, and determine the appropriate settlement amount based on the terms and conditions of your policy. Cooperate with the adjuster and provide any requested information or documentation to expedite the claims process.

- Resolution and Settlement: Once the claims assessment is complete, your insurance company will issue a settlement payment to cover the cost of repairs, replacement, or reimbursement for covered losses. Review the settlement offer carefully and contact your insurer with any questions or concerns.

- Appeal Process: If you disagree with the claims decision or settlement amount, you have the right to appeal the decision and request a reconsideration of your claim. Provide additional evidence or documentation to support your appeal and work with your insurance company to reach a satisfactory resolution.

Protecting Your Sanctuary: Securing Peace of Mind

Your home is more than just a physical structure—it’s a sanctuary, a place of refuge and belonging. Home insurance serves as a vital safeguard, providing financial protection and peace of mind in the face of life’s uncertainties. By understanding the fundamentals of home insurance, tailoring your coverage to your needs, and navigating the claims process with confidence, you can shield your sanctuary and enjoy the comfort and security of home sweet home.

Remember, the power of home insurance lies not only in its ability to rebuild walls and replace possessions but also in its capacity to restore peace of mind and reassure you that, no matter what challenges may arise, your sanctuary remains protected. With the right coverage in place, you can face the future with confidence, knowing that your home is safeguarded against life’s unexpected twists and turns.